Life Insurance in and around Clemson

Coverage for your loved ones' sake

Life happens. Don't wait.

Would you like to create a personalized life quote?

Check Out Life Insurance Options With State Farm

Purchasing life insurance coverage can be a lot to think about with a variety of options out there, but with State Farm, you can be sure to receive reliable caring service. State Farm understands that your goal is to protect the people you're closest to.

Coverage for your loved ones' sake

Life happens. Don't wait.

Clemson Chooses Life Insurance From State Farm

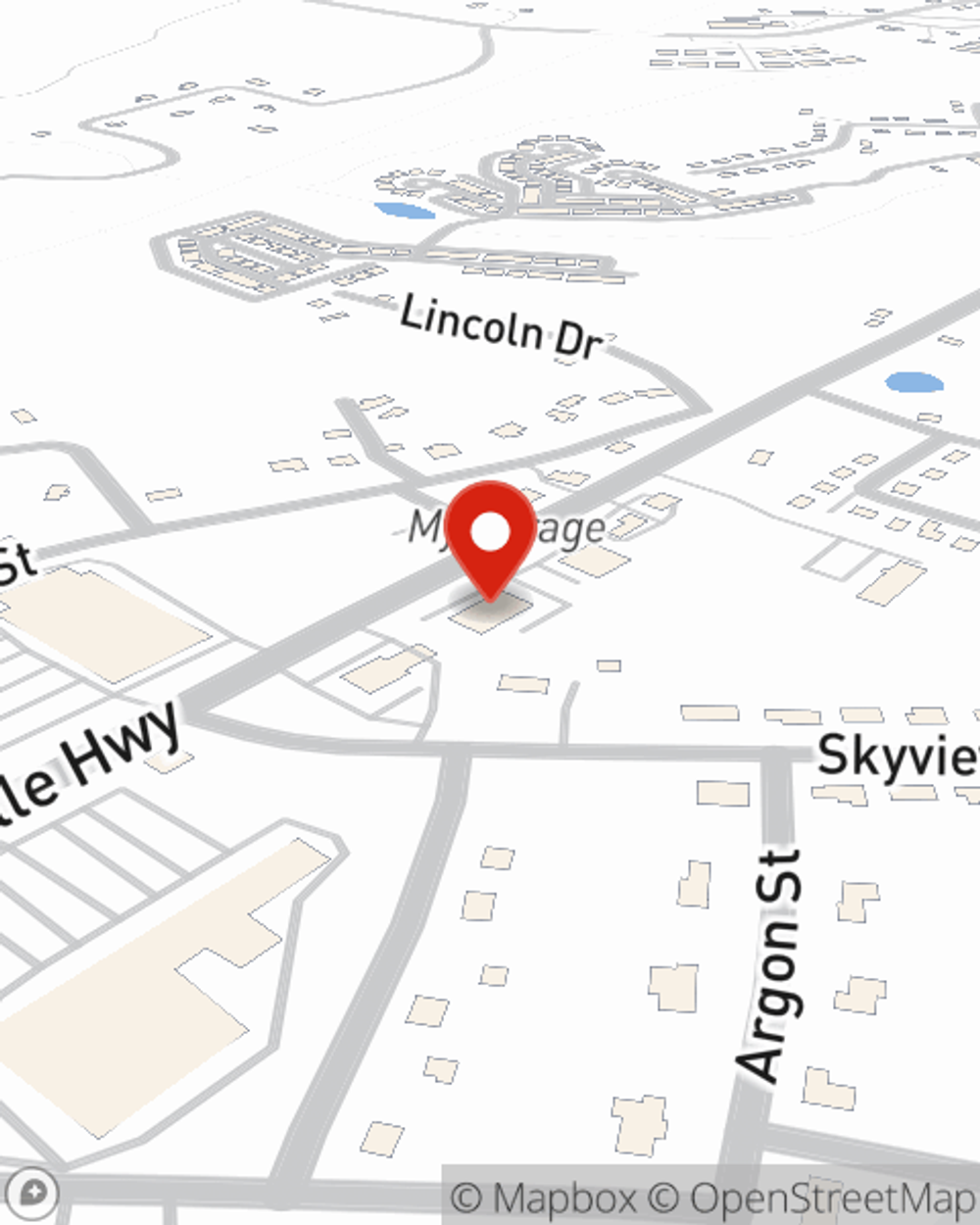

Personalized service is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If tragedy strikes, Lewis Patterson is here to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

It's always a good time to make sure your loved ones have coverage against the unexpected. Contact Lewis Patterson's office to experience how State Farm can help cover your loved ones.

Have More Questions About Life Insurance?

Call Lewis at (864) 654-2420 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Lewis Patterson

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.